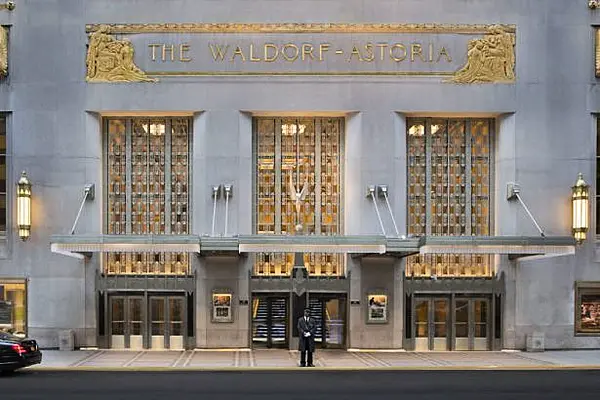

When Anbang Insurance Group agreed to buy New York's iconic Waldorf Astoria hotel for $1.95 billion in 2014, the world took notice. It was a defining moment in the global rise of China Inc., a deal that would help kick off one of the greatest acquisition sprees in history.

But now the Waldorf, along with more than $10 billion of Anbang’s other deals, could become symbols of corporate China’s rapidly shrinking global ambitions. Chinese authorities have asked the embattled insurer to sell its offshore assets and bring the proceeds back home, according to people familiar with the matter, who asked not to be identified because the details are private.

The unprecedented request marks an escalation of China’s clampdown on its biggest overseas dealmakers, which until now has focused on slowing the pace of new takeovers and prodding domestic lenders to pay more attention to their exposure. While there’s no indication that the four other active acquirers singled out by China’s banking regulator in June face similar pressure, the Anbang request underscores President Xi Jinping’s determination to rein in debt-fueled investments and restrict capital outflows before a key leadership reshuffle later this year.

“Anbang’s days as one of China’s most influential firms are clearly over, and asset sales are part of that transformation,” said Christopher Beddor, an associate at political risk consulting firm Eurasia Group. “It’s abundantly clear that the power of the state is increasing vis-a-vis private firms.”

Another Setback

For Anbang, it’s another setback in what has been a remarkable fall from grace. The company rose from obscurity to global prominence in just over a decade until its chairman, Wu Xiaohui, was detained by investigators in June, becoming the most high-profile target of an industrywide crackdown on risky investment practices.

It’s not clear yet how Anbang will respond to the government’s request on overseas asset sales, said the people, who didn’t mention the Waldorf Astoria or any other specific foreign holdings. Anbang hasn’t received such a request and “at present has no plans to sell its overseas assets,” the company said in an emailed statement.

Anbang’s October 2014 agreement to buy the Waldorf, which set a price record in the American hotel industry, catapulted the once-obscure insurer onto the global stage. Over the next two years, Anbang bought real estate and financial services companies in Asia, Europe and North America, including Strategic Hotels & Resorts and an office building in midtown Manhattan to house Anbang’s U.S. headquarters.

The insurer’s rise was fueled by sales of lucrative investment products that offered among the highest yields in the industry. But Anbang’s buying binge fizzled as Chinese authorities cracked down on such products this year, part of a wider campaign to rein in financial risks before the Communist Party’s twice-a-decade leadership reorganization.

“Authorities clearly do not want other insurance companies to copy Anbang’s growth model, which relies on short-term products,” said Steven Lam, a Hong Kong-based analyst with Bloomberg Intelligence. “The signal from the government is very strong on proper asset-liability management and being responsible to policyholders.”

In June, Chinese regulators stepped up scrutiny of other serial dealmakers such as HNA Group Co., Fosun International Ltd. and Dalian Wanda Group Co., asking banks to report their exposures to the companies. At a conference on financial regulation convened by President Xi in July, policy makers pledged to rein in corporate borrowing and said that preventing systemic risk was an “eternal theme.”

Chinese acquisitions, even by firms under regulatory scrutiny, haven’t completely come to a standstill. On Friday, Shanghai-based Fosun, whose businesses range from insurance to pharmaceuticals, said it agreed to team up with a state-backed dairy producer to buy French margarine maker St Hubert for 625 million euros ($733 million). HNA, which has taken on least $73 billion of debt as it transformed from a small regional carrier into a global conglomerate, recently announced it will buy the operator of one of Brazil’s busiest airports.

Still, the pace of deals has fallen dramatically. After a record $246 billion of announced outbound takeovers in 2016, cross-border purchases plunged during the first half of this year. Announced Chinese acquisitions of overseas assets fell 37 percent to $99.9 billion, from $157.9 billion in the same period last year, according to data compiled by Bloomberg.

As the government’s tolerance for debt-funded deals wanes, some firms have already begun selling assets. Wanda, led by billionaire Wang Jianlin, agreed in July to sell most of its Chinese theme parks and hotels for $9.4 billion

Potential Buyers

Anbang’s U.S. assets, which in addition to the Waldorf Astoria include trophy properties such as New York’s JW Marriott Essex House and the Westin St. Francis in San Francisco, may be attractive to sovereign wealth funds because of their prestigious profile, said Lukas Hartwich, a lodging analyst at Green Street Advisors LLC. Blackstone Group LP, which sold Anbang the bulk of the insurer’s U.S. real estate and has previously bought back assets it sold near market tops, would also be an “obvious candidate” as an acquirer, Hartwich said. A Blackstone representative declined to comment.

“These are mostly really nice hotels,” Hartwich said. “The Waldorf is more of a turnaround play to return the hotel to its former glory.”

If China exerts strong pressure to sell, whoever buys is likely to negotiate a discount. “All the potential acquirers know there’s blood in the water and that’s not usually a strong bargaining position to be in as a seller,” Hartwich said.

The Waldorf Astoria may potentially be appealing to a residential developer. Anbang shut the hotel down in March to convert most of the property into luxury condominiums. Christopher Nassetta, chief executive of the hotel’s manager, Hilton Worldwide Holdings Inc., said on the company’s earnings call last week that the project is on track. He said Anbang has told Hilton it has the financial capability to complete the conversion, which is scheduled to take about three years. The market for New York luxury condos has softened as the supply of such properties mushroomed.

Hilton is unlikely to buy back the Waldorf, having spun off its real estate into Park Hotels & Resorts Inc. in January. Park Hotels is focused on internal growth and New York isn’t one of the spinoff’s key expansion markets.

News by Bloomberg, edited by Hospitality Ireland