Ireland's foodservice industry is constantly evolving, making it crucial for operators to understand customer traffic patterns.

Meaningful Vision's latest data provides valuable insights that can help casual dining and pub operators.

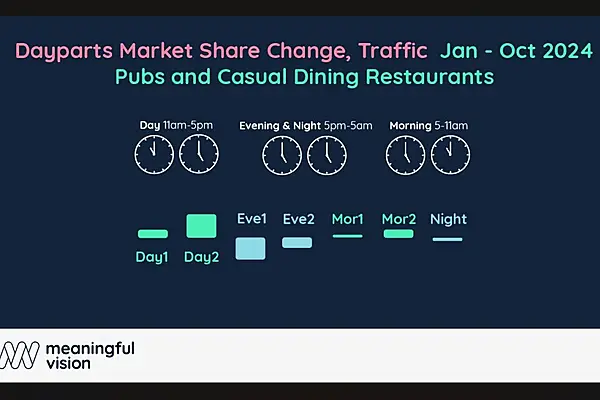

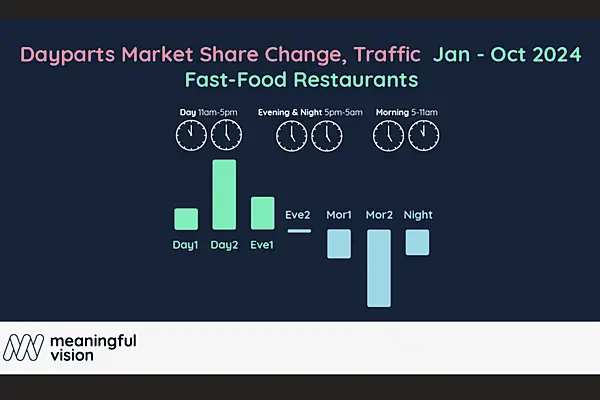

A stark contrast exists when comparing the morning traffic enjoyed by fast-food outlets, with that typically seen by casual dining or pubs. While fast-food, particularly coffee shops and bakeries capture 12% of their daily traffic in the morning, casual dining and pubs experience considerably lower footfall. Breakfast may not traditionally be a core offering for these establishments, successful examples exist however, such as Wetherspoon which ranks among the top five breakfast providers in the UK, despite being a pub chain.

Lunch (12pm - 3pm) is a crucial period for all foodservice segments. Casual dining and pubs see 29% of their daily traffic during this time, slightly exceeding fast-food's 26%. While the fast-food lunch business is driven by bakeries and quick-service options, casual dining and pubs focus on more substantial meals and social gatherings. Lunch is a key revenue driver, characterised by daytime specific offerings, meal deals and convenient ‘light lunch’ options e.g., sandwiches, soups, salads, along with set menus.

The afternoon (3pm - 6 pm) presents a growing opportunity across the board. Fast-food benefits from the demand for snacks and smaller meals, but casual dining and pubs can also capitalise on this trend. Afternoon traffic in these establishments is driven by after-work drinks, early dinners, and social networking. This suggests the potential for targeted afternoon promotions and menus, such as happy hour deals or sharing platters.

Dinner (6pm - 9pm) is a key battleground. Fast-food draws 15% of its daily traffic during these hours, primarily from burger and pizza sales. Dinner is a crucial period, driven by full course meals, special occasion dining, and pub fare.

Late-night traffic (after 9pm) is declining across the board, impacting both fast-food and casual dining/pubs. Late-night business in these establishments has decreased, reflecting broader trends.

Maria Vanifatova, CEO of Meaningful Vision Ltd, emphasises the dynamic nature of Ireland's foodservice market. By understanding these daypart trends and segment-specific nuances, operators can optimise their offerings, pricing, and marketing strategies for success.

This article was written in partnership with Meaningful Vision.