Ireland's foodservice sector is experiencing a dynamic transformation, reflecting the nation's broader economic and social shifts. Meaningful Vision's comprehensive analysis of the 60 leading foodservice chains in Ireland sheds light on key trends, particularly in outlet growth and store density.

A High Concentration of Outlets

Ireland boasts a higher concentration of fast-food outlets per capita (28.7 per 100,000 people) compared to Northern Ireland and the rest of the UK. Dublin leads with 54 outlets per 100,000 residents, exceeding even London's density. This robust presence is likely fuelled by Dublin's thriving economy, international businesses, and tourism. The Irish foodservice sector comprises approximately 7,500 restaurants and fast-food locations, with chains accounting for 20% of these establishments and generating 40% of total visits.

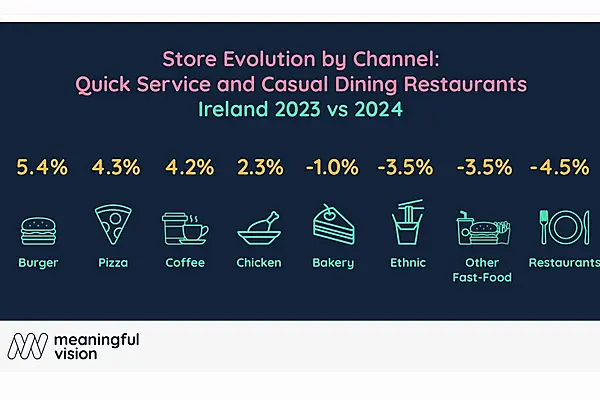

Store Evolution by Channel

Data provided by Meaningful Vision, a company specialising in analysing the performance of the foodservice industry in Europe, reveals interesting trends in store growth across various segments in Ireland. Burger and pizza segments saw the highest growth at 5.4% and 4.3% respectively, aligning with the overall trend of burger dominance in footfall traffic. Coffee and chicken segments also experienced growth, while bakery, ethnic, other fast-food, and restaurants segments saw a decline. This data suggests a shifting consumer preference towards specific quick-service options.

Key Trends and Insights

The 3% year-over-year growth in chain-owned fast-food stores in Ireland indicates a healthy expansion, particularly in the burger and pizza categories. This contrasts with the UK, where chicken fast-food has been the fastest-growing segment. The arrival of Wendy's in 2025 is expected to further intensify competition in the burger market.

These insights highlight the importance of understanding the specific dynamics of the Irish market. While global trends play a role, local preferences and economic factors significantly influence the foodservice landscape. Operators must adapt their strategies to capitalize on the growth in key segments and navigate the challenges presented by evolving consumer behaviour.

This article was written in partnership with Meaningful Vision.