For Irish tourism, 2015 was a remarkable year. Record numbers touched down in the country, while hotels all over were at capacity. However, there are still a number of issues for those responsible for promoting tourism to consider, including rising prices and a visitor profile that is increasingly Dublin-centric. John Golden reviews Fáilte Ireland’s plans for 2016.

In January, Fáilte Ireland welcomed members of the press to its headquarters in Dublin's Amiens Street to review 2015 and to gauge the year ahead. Speaking at the event were Michael Cawley, Fáilte Ireland's chairman and its chief executive, Shaun Quinn.

The Tourism Industry Review was held to discuss the performance of businesses within the sector via Fáilte Ireland’s Tourism Barometer, while also examining the challenges faced by the industry in the year ahead, including the worrying trend of rising prices, the scramble for hotel rooms in Dublin, regional tourism, and the potential of Irish tourism brands.

Overall, there was cause for optimism, and even cautious celebration, as several factors combined to make it a successful year for Irish tourism. A return to economic stability and favourable exchange rates - not to mention the fact that Ireland was being feted by various news outlets as one of the must-see tourism destinations – saw a tourism sector on the up and up.

Indeed, it was no secret to anyone following the news that 2015 was the best year ever for Ireland in terms of visitor numbers to the country. At a glance, the numbers look impressive. Some 7.9 million people visited the country – an 11-per-cent increase on the previous year and the highest since 2007.

Overseas visitor spend in Ireland was up by 13 per cent to €4.1 billion, as hospitality businesses almost universally reported positive results. Breaking that figure down by region, we see very positive results from North America and Mainland Europe. Visitor numbers from North America increased by 13 per cent to 1.3 million. Crucially, said Michael Cawley, while that figure only represents 16 per cent of the total visitor volume, they account for 25 per cent of the spend.

Mainland Europe increased by 14 per cent, while British numbers were up by 8 per cent, which, Cawley admitted, was still underachieving compared to some years ago, when four million people were visiting from the UK.

“Our most important market has not quite got back to the levels it was at, despite the 8-per-cent volume growth in the last year, but we’re getting there. We had phenomenal traffic between Ireland and the UK [around 2007], when we were one of the biggest exit markets for UK visitors after Spain and France, so to be edging back up to that, in my view, is a very commendable performance, and I think we’ll see more of that again if the number of flights from Britain to Ireland projected for this year is any indication of the tourism growth. We may well get back up to the levels of before in this current year.”

A Barometer of Success

Fáilte Ireland's Tourism Barometer is a survey of tourism businesses designed to provide quantitative and qualitative insight into tourism performance for the year to date, and prospects for the following year.

Irish hospitality owners are asked how their businesses fared in 2015 and their expectations for 2016. Of the 397 respondents to the online survey and 150 telephone interviews, the overwhelming picture created was one of positivity and optimism.

In its Business Sentiment Index, 82 per cent of PSA businesses (hotels, guesthouses and B&Bs) reported an increase in business in 2015. Contrast this with 2008, for example, when only 14 per cent improved. For hotels alone, this number improved again, as 84 per cent of respondents reported businesses to be up, while a similar number expected profits to increase in 2016.

“What’s really good about it is that the business sentiment that’s coming back to us about the coming year is really good. Now, this hopefully does not translate into complacency, and we certainly wouldn’t be complacent here. We have a number of key challenges on the horizon, and we hope we can help solve some of the issues that are out there,” said Cawley.

Bang For Your Buck

One of those issues at the top of the agenda was value for money. Thankfully, the days of 'rip-off Ireland', when arrogant business owners combined outrageous prices with poorly trained staff, appear to be in the rear-view mirror. Ireland is not, nor will it ever be, a cheap destination for holidaymakers, however, keeping the country competitive compared to other European destinations is of the utmost importance, said Cawley.

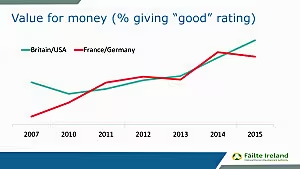

“Value for money in comparison with cities in Continental Europe has been perceived as good. However, I think it masks the reality, frankly. The bulk of what we’re seeing here is that the ratings from the strong currency-source markets – Britain and the US – are saying we’re getting better and more competitive. In reality, their currency is just relatively stronger than the two previous years. The euro-based people are saying we’re getting more expensive, and that’s the key issue.”

Cawley went on to say that although the landscape in hospitality has changed since 2007 and businesses have incurred costs that they have to recoup, the end result can’t be prohibitive pricing.

“Our underlying cost-creep is at an unacceptable level. It is primarily related to the rate of growth, and businesses will say their costs have risen, but it’s our job as the authority vested with the job of growing tourism to find out the risks here. The fact is, our customers are telling us that they find us to be less competitive than before if they’re coming from the Eurozone, and we can’t ultimately depend on strong currencies to save us from becoming uncompetitive in Europe – and that seems to be what’s happening – because when currencies realign, as they do, we’ll be in trouble here.”

The issue of ‘price gouging’ can provoke umbrage from hospitality owners, who only now are beginning to recover profits after nearly a decade of struggling. However, prices are undoubtedly on the rise for hotels and, at least anecdotally, for restaurants also. High prices used to be the reason most cited by people, after the weather, to explain why they wouldn’t return here. Lamentably, we can’t control the weather, but the price issue is something addressable.

No Room At The Inn

Supply and demand is the main market- driver for price, and right now, demand for bedrooms (especially in Dublin) is high. Worryingly, supply is low and won’t get much higher for a couple of years.

The year 2015 was a record one for hotel sales in Ireland, with over €1 billion worth of deals made, but it was more a case of hotels changing hands than new properties being developed. The fact is, Dublin has over 3,000 fewer beds now (41,816) than it did in 2010 (44,929).

Crowe Horwath recently conducted a study that found that an extra 5,000 beds are needed in the capital to cater for demand. However, the majority of new hotels in the works won’t be completed until 2018 or later, which means that demand will only go up over the next two years, thus, prices will almost certainly go up with it.

Projections based on current planning permissions show that we will only get back to 2007 levels by 2020, which is probably not enough time to deal with the growth in areas such as corporate tourism. This creates the need for all types of accommodation in the city, not just high- end places, says Cawley.

“We need a new flow of accommodation – not just hotel rooms, but other types of accommodation – to come and fill that gap for people in every price bracket. The average hotel room at the moment is €110, but there’s a big, big market below €110, which has to be satisfied.

“For these people, accommodation is just one element. When they’re here, they buy drinks, they’ll rent cars, and they certainly eat in restaurants, creating employment and economic activity, so it’s very important that they don’t fall at the first hurdle of accommodation, as the multiplier effect is so important to the country.”

However, where some see crisis, others see opportunity, and the lack of hotel rooms in the capital is an opportunity to push visitors into regional towns and cities, where the impact of increased tourism has not been as pronounced, perhaps.

“The silver lining is that this may actually help us with regionality. We have a shortage of hotel rooms in Dublin, part of which is because the supply is very strong – particularly in peak months, there is an opportunity for tour operators, and we’re working with them to make it happen, to put packages together to take tourists out of Dublin. We have a situation where people are staying in Dublin and taking day trips to the Cliffs of Moher and the Ring of Kerry.”

The economics of this tourism model just don’t add up. Rigorous travel schedules make for tired tourists, who are not going to benefit the areas they are visiting economically. A visitor who has to be up at 5.30 a.m. to catch a coach and travel 300 kilometres is probably not going to want to visit a restaurant, pub or any other night- time activity when s/he returns.

“Hopefully, we can create something that offers an even better experience than the current system of people staying primarily in Dublin, or even exclusively in Dublin, and trying to get around the country on day trips. The numbers for Ireland's Ancient East show that 25 per cent of all the visitors that come to the country visit that region, but only 11 per cent have a bedroom. That’s a skewed figure that we want to fix, and we have a strong focus on that.”

Building The Brands

Fáilte Ireland’s various marketing campaigns such as the Wild Atlantic Way, Ireland’s Ancient East and its new Dublin: A Breath of Fresh Air brands have had success, but Cawley believes that while the campaigns are very well known and respected within the country, they are not known outside of Ireland. This is an opportunity for Tourism Ireland – the agency responsible for promoting Ireland as a destination outside of Ireland – to build on what it believes are strong brands.

“Fáilte Ireland’s role in this is to invest in these projects in a big way. Based on the research that we’ve done, we think these are fantastic propositions, and they compare very favourably internationally. However, they are, sadly, not that well known internationally.

“Our research shows that very little is known about it outside the country. We need to communicate it more on the international market, which I regard as an opportunity – it’s a huge untapped market. It’s important to understand that we regard these brands as 20-year projects.”

The agency is putting its money where its mouth is, investing €55 million in these brands in 2016. The main focus over the next few years will be to promote the places that are off the beaten track. Dublin and Killarney are fine, says Cawley. The focus will move towards other places in Ireland that offer a great experience, too.

The tourism industry in Ireland has come out of recovery mode and entered a new phase of expansion. The potential pitfalls are there for all to see, and it is up to all involved, including the tourism bodies, to avoid them and continue to punch above our weight, as we did in 2015.